57 Trucking Industry Statistics and Trends that Mattered in 2025

Managing a fleet is challenging, particularly for small trucking operators who are more susceptible to fluctuating business costs like fuel price surges and labor shortages. By staying informed with the latest trucking industry statistics, you can make proactive decisions, spot opportunities, and avoid potential pitfalls.

Did you know that insurance costs have been a top industry concern or that truck tonnage has grown (although minimally) in 2025? See what trucking trends have developed this year to help you maintain a competitive edge in an industry where navigating tight margins is already tricky. This stats roundup can help you understand economic impacts and how you can adjust to a fast-paced market.

Key takeaways:

- Small fleets dominate the U.S. trucking landscape, representing over 95% of motor carriers.

- Operating costs, insurance, truck and trailer payments, and repair and maintenance are big hurdles for small fleets — and they're getting bigger.

- Despite industry-wide driver wage increases, smaller truckload fleets experienced a slight dip in driver wages.

- Small fleets, especially those with fewer than five trucks, are very efficient and have the fewest deadhead miles.

U.S. trucking industry statistics

The U.S. trucking industry is a cornerstone of the national economy. In 2024, trucks moved an impressive 72.7% of all domestic freight tonnage and generated approximately $906 billion in revenue. Small fleets are driving much of this activity; 95.5% of motor carriers operate with 10 or fewer trucks, underscoring the critical role smaller businesses play. However, crash data shows that more driver coaching may be needed to help improve industry safety.

Trucks transported 72.7% of the total domestic freight tonnage in 2024.

ATA

The broader freight trucking market in the U.S. is estimated to be worth $532.7 billion.

Hardman & WellIn 2024, the total value of freight moving between the U.S., Canada, and Mexico reached $1.6 trillion.

BTSIn 2024, the trucking industry generated 76.9% of the total revenue within the freight transportation sector.

ATAThe trucking sector is expected to maintain approximately 76.8% of the freight market's revenue share through the year 2035.

ATA4,826 large trucks and buses were involved in fatal crashes in 2024.

FMCSAThe estimated freight revenue for the trucking industry in 2024 reached $906 billion.

ATAIn 2024, 55.5% of the total value of freight exchanged between the U.S. and Canada was transported by trucks.

BTSTotal transborder freight saw an 8.4% increase in March 2025 from March 2024.

BTSBy 2035, total truck tonnage is forecast to reach almost 14 billion. This increase depends on economic demand and available driver capacity.

ATAIn March 2025, trucks transported $94.2 billion worth of transborder freight — a 9.5% increase compared to March 2024.

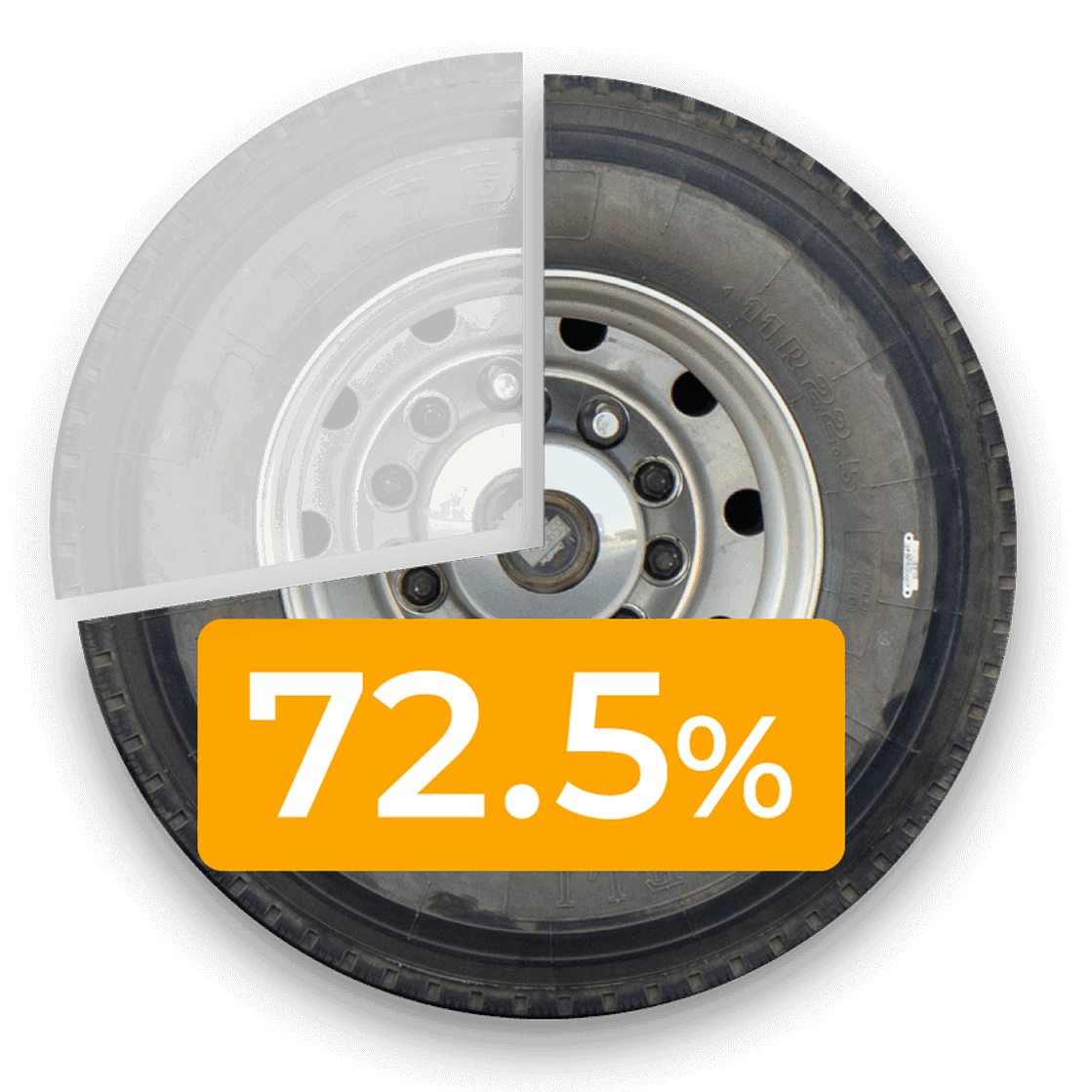

BTSTrucks were responsible for 72.5% of the total value of goods transported between the U.S. and Mexico in 2024.

BTS

The global freight trucking market is projected to grow at a CAGR of 5.4% to reach $3.4 trillion by 2030.

Hardman & Well178,000 large truck and bus vehicles were involved in non-fatal crashes in 2024.

FMCSA

In a 2024 report, it was estimated that there were 39,345 traffic fatalities, a decrease of approximately 3.8% from 2023.

NHTSATruck driver statistics

Behind every delivery and stocked shelf are professional truck drivers who keep goods moving. Understanding driver demographics, employment trends, and challenges is crucial for understanding the industry's outlook; this is especially true for small fleets that rely heavily on their drivers' skills and commitment.

There are 3.55 million drivers employed in the U.S. trucking industry.

ATA

The median age of a professional truck driver in the United States is 46, five years older than the median age of the general workforce.

NATSOIn 2024, truck drivers were mostly white 70.9%, followed by Black/African American 16.1%, Hispanic/Latino 10.1%, and Asian 2.9%.

BLSTransportation industry statistics indicate a total of 9.1 million drivers associated with active motor carriers.

FMCSA14% of truck drivers are female in 2025.

CareerExplorer

Just over 11% of U.S. truck drivers are independent owner-operators.

BLSThere were 2.2 million heavy and tractor-trailer truck drivers in 2023.

BLSAround 400,000 new commercial driver's licenses are issued annually.

OOIDA Foundation

Annual turnover at major truckload carriers often surpasses 90%.

OOIDA FoundationThe average hourly wage for truck drivers was $31.62 in December 2024.

BLSThe lowest 10% of heavy and tractor-trailer drivers earned less than $38,640 annually.

BLSThe median annual wage for heavy and tractor-trailer drivers was $57,440 in May 2024.

BLS

The top 10% of heavy and tractor-trailer drivers earned more than $78,800 annually.

BLSIn 2023, driver wages accounted for $0.779 per mile, a 7.6% increase from the previous year.

ATRIThere are an estimated 800,000 to 900,000 available long-haul trucking jobs.

OOIDA FoundationSmall trucking fleet statistics

Small trucking fleets are the workhorses of the U.S. logistics network — in fact, smaller operations own about half of all trucks on the road. From their widespread presence to the operational costs they face, like the recent 12.5% hike in insurance premiums, these stats shed some light on small trucking fleets that keep goods moving.

As of March 2024, 95.5% of motor carriers operated 10 or fewer trucks.

ATAIn March 2024, 99.6% of motor carriers operated 100 or fewer trucks.

ATA50% of all trucks are owned by fleets of three or fewer.

ATA

Truck fleet size statistics show that businesses with fewer than 50 trucks owned 80% of all trucks.

ATAIn 2023, the total marginal cost of operating a truck reached $2.27 per mile, a 0.8% increase from 2022.

ATRIIn 2023, excluding fuel, the marginal cost of operating a truck rose 6.6% to $1.72 per mile from the previous year.

ATRIOperational costs averaged $91.27 per hour, a 0.5% increase in 2023.

ATRIIn 2023, truck and trailer payments cost $0.36 per mile, an 8.8% increase over the previous year.

ATRIIn 2023, the repair and maintenance cost was $0.20 per mile, a 3.1% YoY increase.

ATRIInsurance premiums cost $0.099 per mile, a 12.5% increase over 2023.

ATRIIn 2023, truckload carriers with fewer than five trucks reported the lowest deadhead miles at 10%.

ATRI

In 2023, 97% of fleets with over 100 trucks used speed governors, compared to 64% of fleets with 100 or fewer trucks.

ATRITrucking employment statistics

Employment extends far beyond the 2.2 million individuals who drive heavy and tractor-trailer trucks. Plenty of other professionals support these drivers, including dispatchers, brokers, logisticians, mechanics, and administrative staff. In 2023, nearly 179,000 people were employed in office and administrative support roles within truck transportation alone.

In 2023, 259,300 heavy vehicle and mobile equipment service technicians were employed, with a median annual wage of $62,740 in 2024.

BLS

In 2023, 38,150 dispatchers except police, fire, and ambulance were employed in truck transportation, earning a mean annual wage of $54,010.

BLSIn truck transportation, 8,230 logisticians were employed, with a mean annual wage of $60,990.

BLS178,640 people were employed in office and admin support, with a mean annual wage of $49,070.

BLS19,940 bookkeeping, accounting, and auditing clerks were employed in truck transportation, with a mean annual wage of $47,530 in 2023.

BLSThere were 17,080 employed customer service representatives in 2023, with a mean annual wage of $46,640.

BLS40,630 general office clerks were employed in truck transportation, with a mean annual wage of $44,440.

BLS16,470 secretaries and administrative assistants excluding legal, medical, and executive were employed in truck transportation, earning a mean annual wage of $41,720.

BLSWhat 2025 Trucking Stats Tell Us About the Road Ahead

Understanding the 2025 trucking industry stats is key to planning for the future of your small fleet. These numbers offer a roadmap, helping you shape your business for what's next. Here's how you can use these trucking industry trends and statistics to manage your fleet in 2026:

- Be smart about tech adoption: Consider selectively investing in smart technology for increased fleet efficiency and safety.

- Explore north-south trade if it fits: Moving freight to and from Canada and Mexico can be profitable, so don't rule it out. Just be prepared for international roadchecks.

- Keep a close watch on insurance: As insurance is a top fleet management challenge, proactively manage this significant and rising expense by switching providers if necessary.

- Use your small fleet's flexibility: Use your fleet's flexibility to serve niche markets more effectively than larger businesses.

- Maximize your miles: Continue optimizing routes and seeking backhauls to reduce your deadhead miles.

- Prepare for more freight: Preparing your fleet for the additional work ahead if tonnage growth picks up by optimizing maintenance schedules to ensure fleet reliability.

- Prepare for more freight: With tonnage projected to grow, preparing your fleet for the additional work ahead by optimizing maintenance schedules to ensure fleet reliability.

- Tackle rising expenses head-on: With operating and insurance costs rising, budget wisely, cut ongoing costs, and actively seek savings when possible.

- Value drivers and actively recruit: Focus on retention and competitive compensation to recruit and retain fleet drivers.

Leverage GPS monitoring for a more profitable fleet with Linxup

Getting a feel for the current and future state of the trucking industry is essential for good business, but you can't manage efficiently if you don't have visibility into your fleet. GPS tracking solutions from Linxup allow fleet operators to track vehicles in real time, monitor driver behavior, and reduce theft and misuse. Prepare for the future by partnering with Linxup for the road ahead — request a demo today.