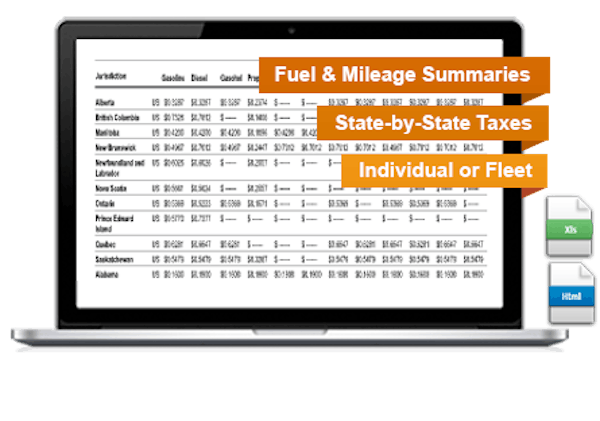

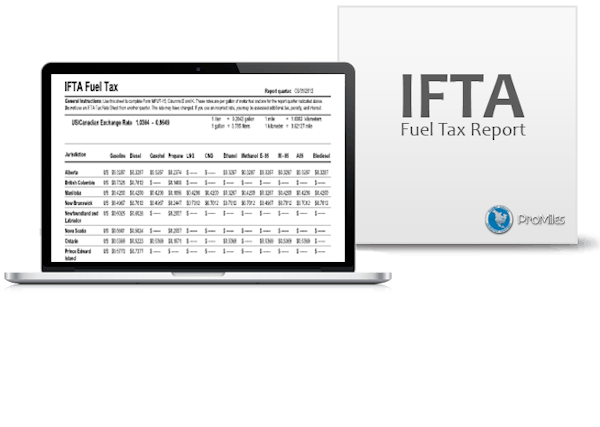

Automate Fuel-Tax Reporting

Do you need to provide International Fuel Tax Association reporting to the Department of Transportation?

For an additional $12 per month, Linxup’s IFTA add-on automatically collects mileage data by integrating seamlessly with your Linxup GPS tracking device. This add-on enables you to:

- Easily complete a variety of reports, including Fuel & Mile Tax Summaries,

- Calculate fuel-tax information for individual vehicles or for your entire fleet

- View actual fuel gallons used, tax rates for individual states, and the amount of fuel tax due

Linxup’s International Fuel Tax Association add-on is approved by all US state Departments of Transportation.