Reduce your Insurance Premiums with Linxup GPS Tracking

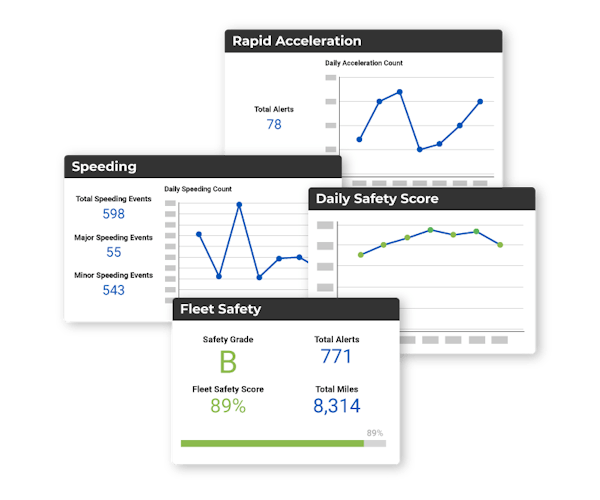

Vehicle insurance doesn't need to be a major source of spending for fleet-based businesses. Fleet managers can reduce their premiums by insuring their vehicles under a single policy, and installing GPS tracking device in fleet vehicles can help reduce insurance premiums even further.

When fleet managers understand how their vehicles are used in the field and work with their drivers to improve their safety, they'll make fewer claims, and that means lower premiums.

GPS tracking devices like Linxup's have helped many fleets reduce their premiums up to 30% by monitoring vehicle usage and driver behavior as well as by improving fleet safety and efficiency.